SSS Online Payment for Self-Employed Members

Have you started your freelancing career as a self-employed professional and would like to pay your SSS voluntary contribution? Lucky you, we are on the same boat. We’ve created this guide on how to pay SSS contribution online, especially for freelancers and digital nomads like us.

We’ve been there. We understand it could get a little overwhelming for you, considering you didn’t have to think about all these government-mandated contributions (SSS, PhilHealth, Pag-IBIG) when you were previously employed. So, we’re here to help and make it simpler for you.

Tip: If you’re an active Pag-IBIG member, you may want to explore their MP2 Savings Program. It allows you to save more and earn more with higher dividend rates.

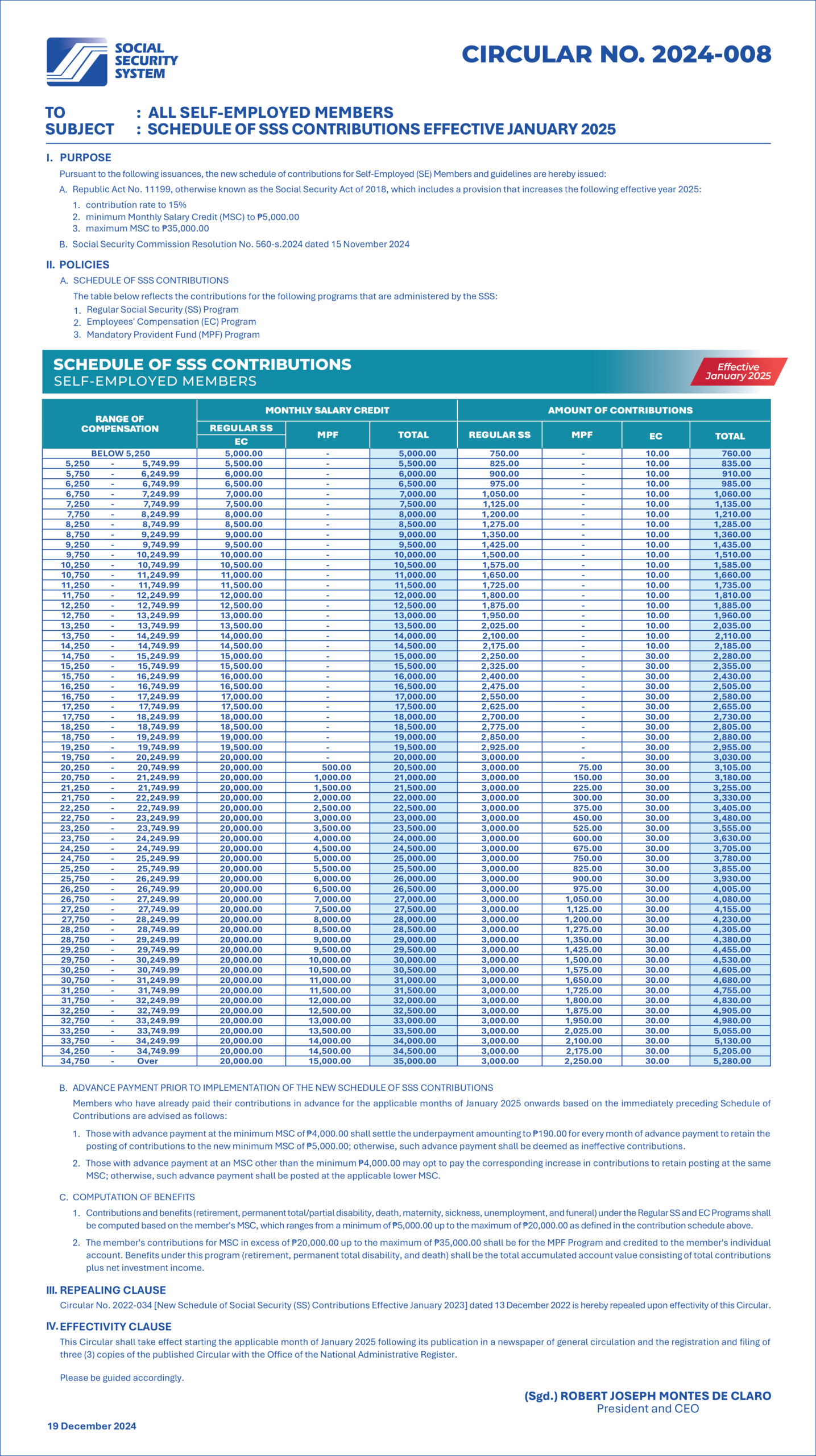

SSS contribution table 2025

Pursuant to the Republic Act No. 11199 (Social Security Act of 2018), the new SSS monthly contribution (effective Jan 2025) for self-employed individuals as well as other member types already increased to 15% with the Minimum Salary Credit (MSC) to ₱5,000, and the maximum to ₱35,000.

Therefore, the minimum SSS monthly contribution this 2025 is now ₱750 and the maximum is ₱3,000.

What does this imply? This means that you are now paying higher SSS contributions but your SSS benefits will also increase based on the new computation.

How to calculate your monthly SSS contribution

1. On the SSS contribution table for self-employed members, see the first column “Range of Compensation” and search for your monthly income range.

2. Know the corresponding “Monthly Salary Credit (MSC)”. For instance, if your declared monthly income is over ₱20,249.99, your Monthly Salary Credit or MSC is ₱20,000.

3. Calculate your SSS monthly contribution by multiplying your MSC and the new 15% SSS contribution rate.

Sample computation for your SSS monthly contribution: ₱20,000 x 0.15 = ₱3,000

You can see this amount under the “AMOUNT OF CONTRIBUTIONS – REGULAR SS” column.

How to pay SSS contribution online

Now that you already know your monthly SSS self-employed contribution amount, you may follow the steps below for your SSS online payment.

Step 1: Log-in to your SSS online portal

Log in to your My.SSS Member Account on the SSS website.

If you don’t have your SSS online account yet, you should create one before you can pay your SSS online. You may refer to this guide on how to create your My.SSS Member Account.

Step 2: Generate Payment Reference (PRN)

2.2 Go to the Payment Reference Number tab → Contributions.

2.3 Input the needed details such as your Membership Type, Applicable Period, Contribution, and Voluntary Pension Booster Amount (if applicable). Click “Generate PRN”.

Step 3: Pay your SSS contribution online

Once you submit your request, you will be redirected to a review page where you can see your Payment Reference Number (PRN) and the Grand Total to pay. Take note of your Payment Reference Number since you will need to provide this to pay your SSS contribution online.

SSS online payment methods

You can pay your SSS online via different online payment methods.

Option 1: Billeroo

If you proceed to click the “Pay” button, you will be directed to the Billero portal, where you have payment options including bank transfers, credit/debit cards, and e-wallets like Gcash, Maya, and Grab Pay.

Applicable service fees apply. For instance, if you are paying for a one month contribution of ₱750, there is a service fee of ₱23 for GCash, Maya, GrabPay, and credit / debit card payments via Billeroo.

Personally, we haven’t tried using Billeroo to pay for our self-employed SSS as we prefer other payment options below.

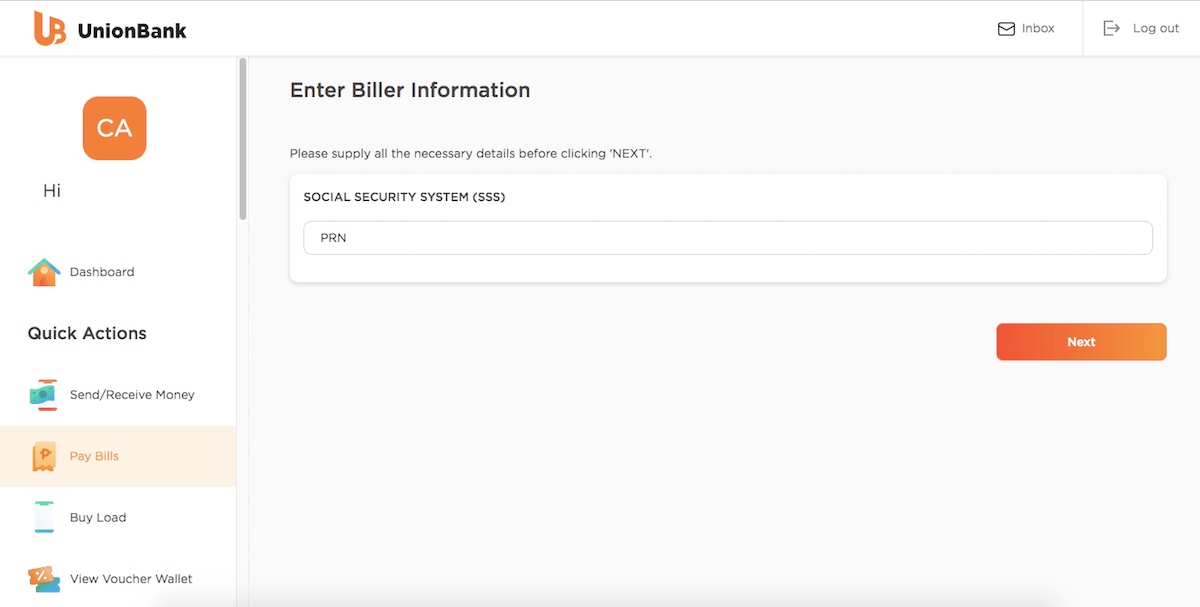

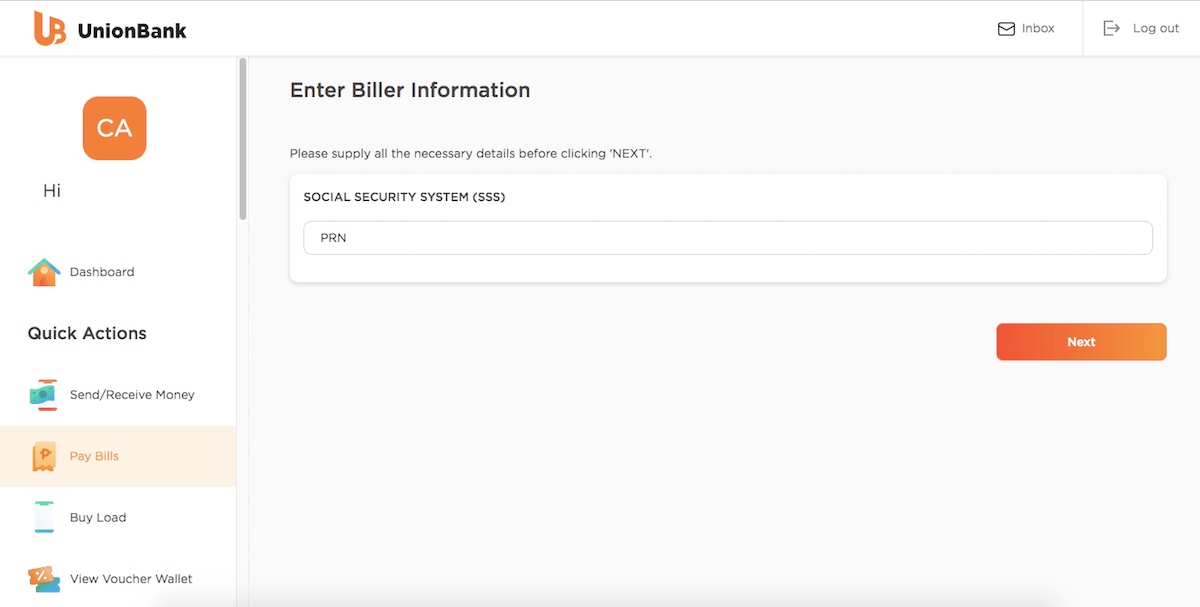

Option 2: UnionBank

We’ve been using UnionBank for our SSS online payment since it’s free. If you have a UnionBank online account, we suggest that you take advantage of it.

Just log-in to your account, select Pay Bills, input the PRN, and pay. It’s fast and convenient with NO service fees so you’ll save on payment costs compared to other SSS online payment methods.

Option 3: GCash

Log-in to your GCash app, go to Pay, Bills, Government, and search biller SSS CONTRIBUTION. Fill in the needed details including your PRN. Do note that there is a service fee of ₱8 per transaction.

Option 4: BancNet

You may also use BancNet but you will need to register a BancNet online account if you don’t have one yet.

Once you have your account, log-in and select a partner bank that you have an account with. Go to “Payments” and select “SSS”. Enter your details such as ATM card number and amount of your monthly SSS contribution. Input your PIN and submit.

Personally, this will be the last payment method we would try as we are concerned of potential privacy and security issues considering you will need to input your ATM PIN and use your direct savings or current account. But it’s really up to you – whichever is convenient and accessible.

We pretty much covered everything you need to know on how to pay SSS online. If we missed anything, feel free to let us know our social media channels: Facebook, Instagram, Twitter, and YouTube.

*Screenshots taken from SSS and the respective digital portals.