Pag-IBIG Online Payment Guide for Self-Employed Members

Are you a freelancer, self-employed professional, or independent contractor who wants to pay your Pag-IBIG voluntary contribution? We’ve created this Pag-IBIG online payment guide, especially for freelancers and digital nomads like us who are always on the go.

We understand how tedious it is to voluntarily pay government-mandated contributions such as SSS, PhilHealth, and Pag-IBIG, so we’re making it simple for you.

Pag-IBIG contribution 2026

So, how much should you pay for your Pag-IBIG monthly contribution?

Since Feb 2024, the new mandatory Pag-IBIG monthly contribution is ₱200 (employee’s share) and ₱200 (employer’s share).

For self-employed professionals and freelancers, the mandatory Pag-IBIG monthly contribution is ₱400 since you will shoulder both the employee’s and employer’s share.

You can pay higher than ₱400, especially if you plan to get a loan or want to save more. Read more FAQs about the Pag-IBIG Regular Savings Program.

Changing Pag-IBIG membership category

Do note that if you were previously employed, you need to change your membership category to voluntary membership to pay your Pag-IBIG monthly contribution online.

To change your Pag-IBIG membership category:

- Download the Member’s Change of Information Form (MCIF).

- Go to the nearest Pag-IBIG branch and submit the form. Bring one (1) valid ID with a photocopy of it.

- It only takes a few minutes to update your Pag-IBIG membership category once your MCIF is processed by the officer.

Tip: SM Malls have Government Services Express, a one-stop shop for government agencies, including Pag-IBIG, PhilHealth, SSS, NBI, and more. You can update your Pag-IBIG information there if it’s available in your area.

Once your membership category is changed, you can already start paying your Pag-IBIG contribution online.

Pag-IBIG online payment steps

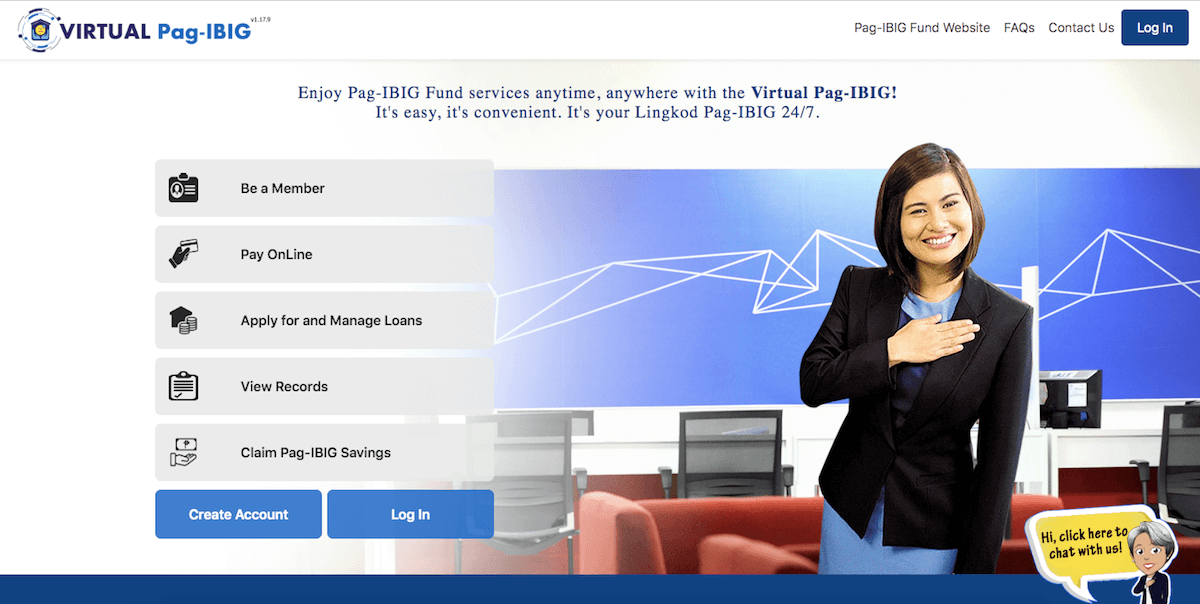

Step 1: Log in to Virtual Pag-IBIG online

Go to the Virtual Pag-IBIG member portal and log in to your account.

If you don’t have a Virtual Pag-IBIG account yet, click “Create Account”. Be sure to prepare the following before creating your Pag-IBIG online account:

- Pag-IBIG Membership ID or MID (12-digit number)

- Active mobile number to receive your One-Time Pin (OTP)

- Active email address to receive your temporary password

- Two (2) valid government ID photos

- Selfie photo with your valid ID

Step 2: Go to Regular Savings

Under PAYMENTS, click “Pay Online”. Then, “Regular Savings”. You will be redirected to a page where you need to fill in some payment details.

Step 3: Fill in the payment details

Complete the following fields:

- Membership Category

- Payment Method

- Pag-IBIG MID No. (Click “Verify” after you typed your MID. It will verify and autofill your Member’s Name)

- Membership Savings (Enter the amount of your Pag-IBIG contribution)

- Period Covered From

- Period Covered Duration

- Period Covered To

After putting all the information, it will show your Amount Due, Convenience Fee, and Total Amount Due.

Click “Next” after reviewing everything.

Step 4: Provide your billing address and contact information

Input your Billing Address, Mobile Number, and Email Address. Then, enter the CAPTCHA code, tick “I Agree with the Terms and Conditions”, and click “Next”.

Step 5: Review the payment summary

After you input your details in the previous steps, you will see your Pag-IBIG monthly contribution payment summary. Review everything before you click “Proceed”.

Step 6: Pay your Pag-IBIG contribution online

Depending on what you chose as your payment method, you will be redirected to the respective payment platforms.

If you choose the credit or debit card, you will be asked to provide your card number. If you picked Maya or GCash, you will be asked to log in to your respective e-wallet accounts.

Take note of the following convenience fees:

- Maya / GCash – ₱5

- Credit / Debit Card – 1.75% of the total amount

That’s basically all the steps on how to pay Pag-IBIG online.

Since you’re paying your Pag-IBIG self-employed contributions, why not pay your SSS contributions and PhilHealth contributions, and Pag-IBIG MP2 Savings online, too?

If you found this Pag-IBIG online payment guide useful, please share it with your friends. Let’s also connect on Facebook, Instagram, Twitter, Pinterest, and YouTube.

*Screenshots taken from Virtual Pag-IBIG.