Pag-IBIG MP2 Savings Guide: How to Enroll, Pay Online, and Earn

Great news to all Pag-IBIG members! Do you know that you can actually save and invest more with the Pag-IBIG MP2 Savings Program?

After legitimizing my self-employment with BIR and fixing all my voluntary contributions (SSS, PhilHealth, Pag-IBIG), I’ve been exploring other investment options to diversify my portfolio and potentially earn more as a digital nomad. I’ve read from various sources and heard from friends that the MP2 Pag-IBIG fund is a good kind of investment, especially if you don’t have a high-risk appetite. So, I finally enrolled and paid my first Pag-IBIG MP2 contribution.

Before writing this guide, I made sure to go through the process myself, from the Pag-IBIG MP2 enrollment to online payment. I didn’t even have to go to a Pag-IBIG branch. I did everything online, and I’m sharing the steps with you. Thank me later!

What is Pag-IBIG MP2?

The MP2 or Modified Pag-IBIG 2 is a voluntary savings program by Pag-IBIG where you can save more and earn higher dividend rates than your mandatory Pag-IBIG Regular Savings. It has a 5-year maturity, but you can choose to withdraw your dividends annually or after 5 years.

But what’s a dividend?

If you’re not familiar with the financial terms, you might be wondering what a dividend is. It is actually the distribution of profits by a corporation to its shareholders. In Pag-IBIG’s case, it invests at least 70% of its investible funds in housing finance, corporate bonds, and government securities. The profit earned from this is distributed to Pag-IBIG members as dividends. It’s like the interest you earned from your Pag-IBIG MP2 savings.

So, is Pag-IBIG MP2 a good investment?

Yes, Pag-IBIG MP2 is definitely a good investment since this allows you to save your money as a passive income. If you save more, you’ll earn more. You really have nothing to lose — it’s a safe, tax-free, and government-guaranteed investment that is not so restrictive. Plus, you have the option to withdraw your dividends every year or after 5 years.

Pag-IBIG MP2 Dividend Rates

Compared to the Pag-IBIG Regular Savings or other bank savings interests, MP2 has higher dividend rates, allowing you to earn more. See MP2 Savings Dividend Rates below:

| Year | MP2 Savings Dividend Rate |

| 2024 | 7.10% |

| 2023 | 7.05% |

| 2022 | 7.03% |

| 2021 | 6.00% |

| 2020 | 6.12% |

| 2019 | 7.23% |

| 2018 | 7.41% |

| 2017 | 8.11% |

| 2016 | 7.43% |

| 2015 | 5.34% |

| 2014 | 4.69% |

| 2013 | 4.58% |

| 2012 | 4.67% |

| 2011 | 4.63% |

*Source: Pag-IBIG Official Website

Since the start of the program in 2011, the dividend rates range between 4.58% and 8.11% with an average of 6.24%. Given those numbers, we can assume that the MP2 dividend rates for 2025 and 2026 would be somewhere near the average or even more. You may visit Pag-IBIG’s official website for the official MP2 dividend rates per year.

Pag-IBIG MP2 Savings Monthly Contribution

So, how much is Pag-IBIG MP2 monthly? As of January 2025, the minimum MP2 monthly contribution is ₱500, but there really is no limit to the amount you can put in your MP2 savings. However, for savings above ₱100,000, you will need to provide your proof of income/source of funds. And, for one-time savings above ₱500,000, you need to remit via personal or manager’s check.

How much will I earn in MP2?

To give you a better idea as to how much you will earn with MP2, see Pag-IBIG’s sample computation below based on a 7.5% dividend rate:

₱500 monthly savings

₱1,000 monthly savings

₱1M one-time savings

*Table screenshots taken from Pag-IBIG MP2 Official Website.

What are the Pag-IBIG MP2 requirements and eligibility?

If you are interested in opening an MP2 account, here are the requirements and eligibility:

- Active Pag-IBIG members with at least one (1) month savings contribution in the last 6 months.

- Former Pag-IBIG members including retirees and pensioners with at least 24 monthly savings prior to retirement. There is no age limit so long as you have other sources of income.

- Natural-born Filipinos who reacquired their Filipino Citizenship under RA 9225, with at least 24 monthly savings prior to permanent migration to a foreign country.

How do I open an MP2 account?

If you are eligible, you can open a Pag-IBIG MP2 account anytime. There are two ways to create an MP2 account:

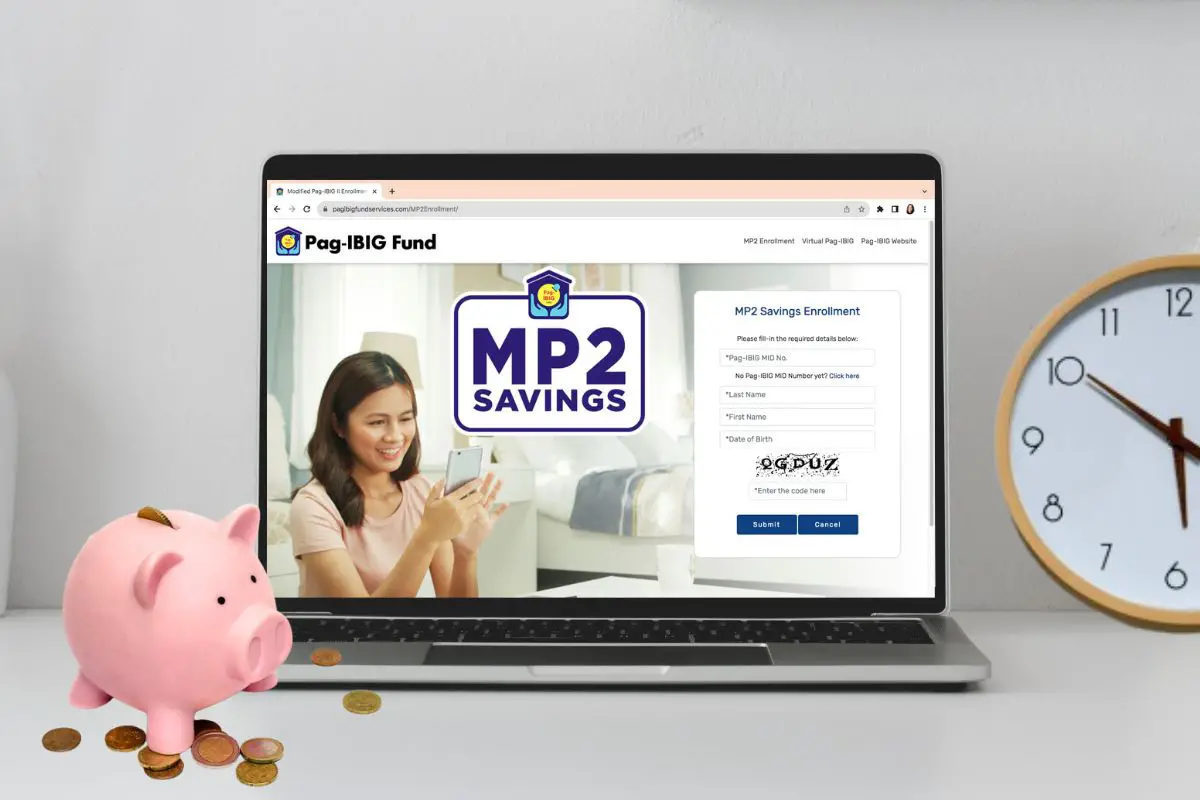

Option 1: Pag-IBIG MP2 enrollment online

Step 1: Visit the MP2 Savings Enrollment portal

Go to the MP2 Savings Enrollment portal. Then, input the required fields including your Pag-IBIG MID Number, Last Name, First Name, and Date of Birth. Enter the captcha and click “Submit”.

Step 2: Input and confirm your MP2 details

After you sign up, you will be redirected to a page where you will need to input and confirm some details including:

- Source of Funds

- Preferred MP2 Dividend Payout: Annual or Five-Year (End Term)

- Mode of Payment

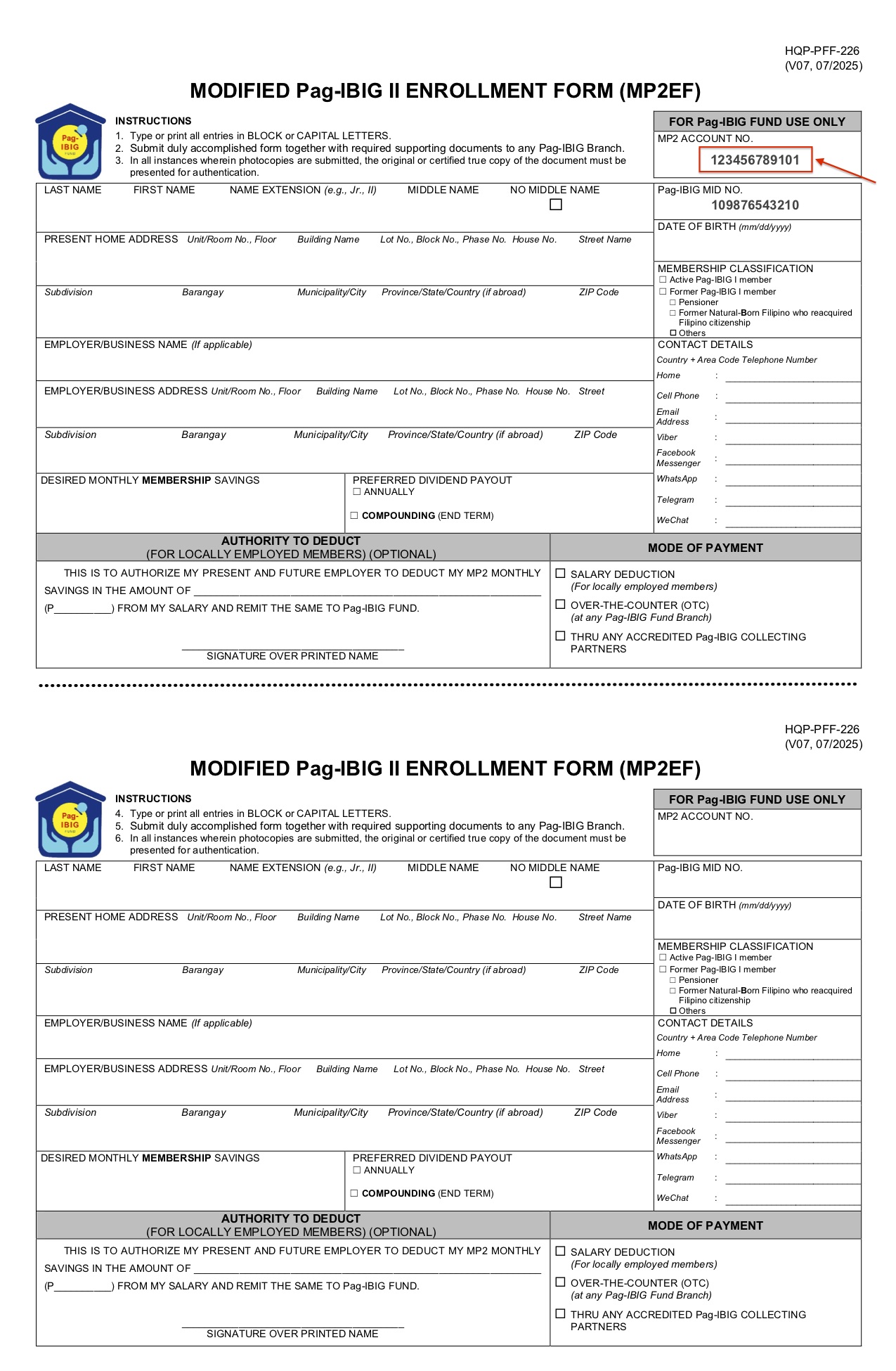

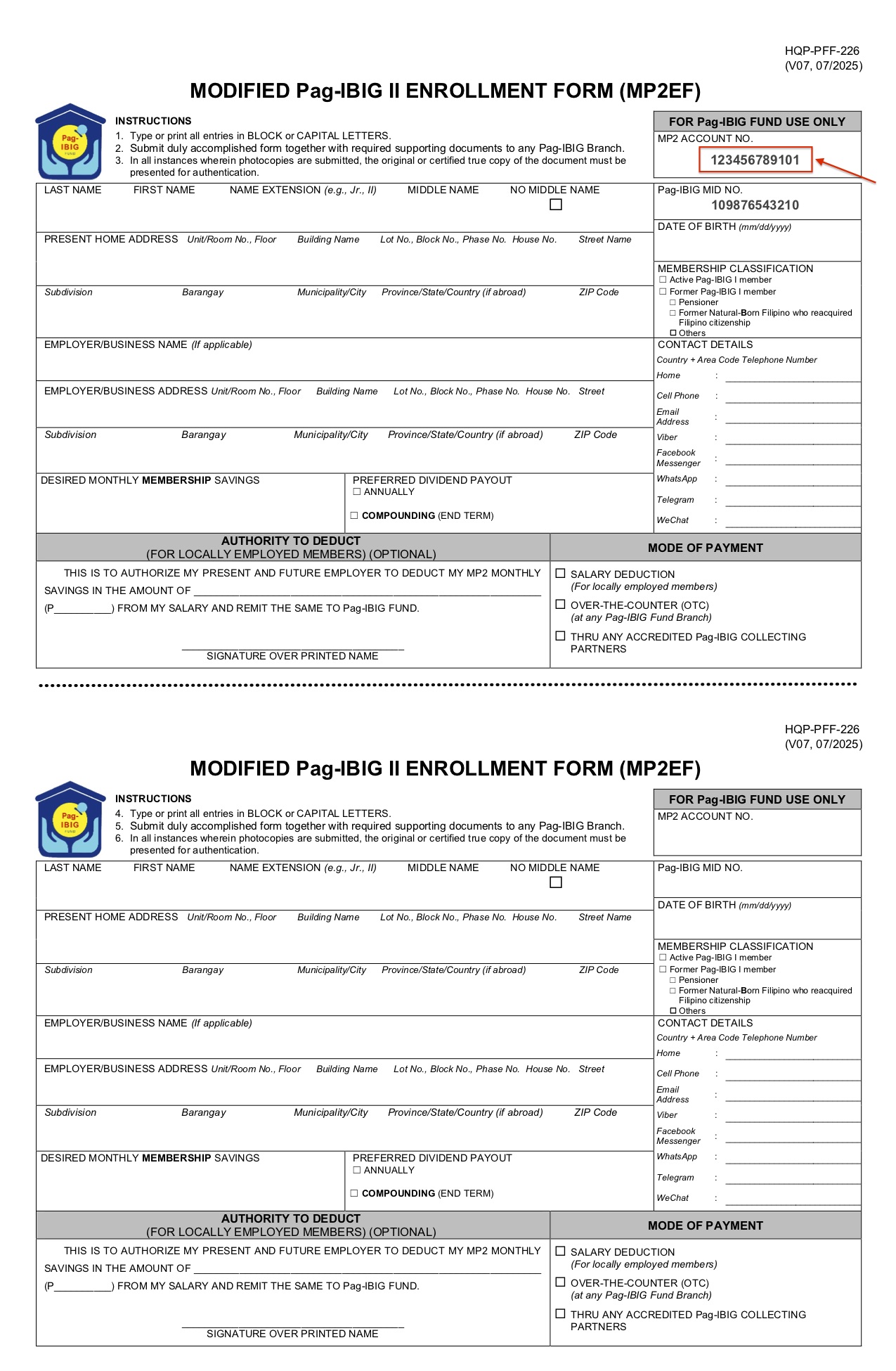

Step 3: Generate and save your Pag-IBIG MP2 enrollment form

After submission, you will receive your MODIFIED Pag-IBIG II ENROLLMENT FORM with your personal details including your 12-digit MP2 Account Number.

Save this PDF document for future reference. You can also have it printed if you wish. Take note of your MP2 Account Number since you’ll need this to pay for your MP2 monthly savings.

Option 2: Apply at any Pag-IBIG branch

You can also apply to the nearest Pag-IBIG branch and submit the following requirements:

- Completely filled out MP2 Enrollment Form

- Valid ID and one (1) photocopy

- Photocopy of Philippine Passport (for natural-born Filipinos)

- Proof of Income / Source of Fund

Pag-IBIG MP2 payment

You have several options to pay your Pag-IBIG MP2 monthly contributions.

Option 1: Pag-IBIG MP2 online payment

To pay your Pag-IBIG MP2 online, go to the MP2 payment portal and fill in the payment details including your 12-digit MP2 Savings Account Number. You cannot proceed with the payment if you don’t have your MP2 account number yet.

Alternatively, you can also log in to your Virtual Pag-IBIG account, follow the Pag-IBIG online payment steps, and select MP2 Savings under Payments. The MP2 payment process is the same as paying your Pag-IBIG Regular Savings.

Do take note of the convenience fees when paying your MP2 contribution:

- GCash / Maya – ₱5

- Debit / Credit Card – 1.75% of the total amount

After payment, you will receive a payment confirmation via email.

Option 2: Pag-IBIG accredited collecting partners

You may also pay your MP2 contributions via the accredited collecting partners including:

- Bayad Center

- SM Business Services

- M. Lhuillier

- Asia United Bank (AUB)

- ECPay

*See complete list of Pag-IBIG MP2 payment channels.

Option 3: Pag-IBIG branch

You may also proceed to the nearest Pag-IBIG branch and make an over-the-counter payment.

How do I check my MP2 savings contribution?

To check your MP2 contributions, you need to log in to your Virtual Pag-IBIG account. Go to PRODUCTS → MP2 Savings.

Don’t be surprised if your MP2 savings contribution is still not reflected on your Virtual Pag-IBIG account after making the payment. Verification and posting could take time so you can check it at a later date. Mine took a few days before my MP2 contribution was posted.

How can I claim my MP2 savings?

Here are ways to claim your MP2 dividends:

Option 1: MP2 Savings withdrawal online

After the 5-year maturity, you can claim your MP2 savings online via the Virtual Pag-IBIG. Visit the MP2 Benefit Claims page and read the reminders. Be sure to prepare these documents before proceeding:

- Claim Application Form

- One (1) valid ID and photocopy

- Cash card (Loyalty Card Plus)

- Selfie photo showing your ID and cash card

Option 2: Any Pag-IBIG branch

You can also claim your MP2 savings at any Pag-IBIG branch. Download and accomplish the Application for Provident Benefits (APB) Claim form, and submit it to the nearest Pag-IBIG branch.

Can I terminate and withdraw my MP2 Savings before the 5-year maturity?

Yes, you can pre-terminate and withdraw your MP2 Savings even before the 5-year maturity period given the following reasons:

- Total disability or insanity

- Employment termination due to health reasons

- Unemployment due to company closure or layoff

- Retirement

- Permanent migration to a different country

- OFW repatriation

- Death (beneficiaries to receive your MP2 savings)

- Critical illness of the account holder or the immediate family, certified

by a licensed physician, but still subject to approval by Pag-IBIG - Other grounds approved by Pag-IBIG’s Board of Trustees

Are there penalties if I pre-terminate my MP2 Savings?

There is no penalty if you pre-terminate your MP2 savings provided you have the reasons stated above. In fact, you can still get your principal amount and a portion of the dividends you earned in the previous years and the current year.

How much will I get if I pre-terminate my MP2 Savings?

For annual dividend payouts

- Principal MP2 Savings + 50% of the total dividends earned from previous years to be deducted from proceeds

- 50% of the dividends earned for the current year, but will only be released after the dividends for the current year have been declared

For 5-year (end-term) dividend payouts

- Principal MP2 Savings

- 50% of the total dividends earned from previous years

- 50% of the dividends earned for the current year, but will only be released after the dividends for the current year have been declared

Tips

- Just do everything online — from MP2 enrollment to payment. This saves you time and transport costs. You also don’t have to fall in line waiting for your turn at Pag-IBIG counters.

- When paying online, you can opt for GCash or Maya since the convenience fee is only a flat rate of ₱5 regardless of the amount.

- If you can, pay your MP2 monthly contribution in bulk, especially in the first year. Not only can you save on convenience fees, you’ll also get higher returns.

- The amount you put in your MP2 savings should only be an extra money for investment. Do not treat it as an emergency fund since you cannot withdraw it anytime you want. Although you can choose to withdraw your dividends yearly, there is still a maturity period of 5 years. MP2 savings should be taken as a long-term investment.

That’s it. I hope I covered the basics. I’m also a newbie to MP2 savings, so if you have more tips and recommendations, feel free to get in touch on Facebook, Instagram, Twitter, Pinterest, and YouTube.

*All screenshots taken from Pag-IBIG Official Website and Virtual Pag-IBIG.